An MPESA Statement is an alternative means of knowing your financial standings that would otherwise be depicted by your bank statements. It’s equally an easier way to analyze the financial standings of people not easily vettable by their bank statements (if any)

Fintech platforms have greatly revolutionized the finance market in Kenya. In fact, statistics from the financial sector Kenya deepening (FSD) show that mobile lending has more than doubled over the years. This has highly impacted the credit sector with many households accessing loans straight from their mobile devices. Despite the milestone achieved in bridging the gap for the un-bankable Kenyans, loan defaulting remains a thorn in the flesh.

A report released by the credit Referencing Bureau (CRB) indicates that 70% of mobile loan defaulters are likely to borrow again and still default. In another report published by Business Daily, a top-tier business publication in Kenya, the number of loan defaults in traditional finance institutions has crossed the Kshs 403 billion mark. Though this may be attributed to a souring economy linked to the advent of covid 19, the need to review the credit history of borrowers cannot be underscored.

To counter the effects of digital loan defaults, Bayes, like many other digital lenders have opted to increase surveillance by putting in place various checks and balances in loan applications. In that case, most digital lending platforms are now asking for at least a six months MPESA statement to verify the financial ability of borrowers.

However, a move by most digital lenders to impose strict measures on loan applications has helped alleviate loan defaults. So, how has the MPESA statement requirement impacted the digital lending market? We put that into perspective.

Mpesa Statement requirement

Though most digital loan platforms do not lock out CRB-listed individuals from applying for loans, borrowers are required to provide their MPESA statement. This helps lenders to ascertain the financial health of borrowers before approving their loan requests. The requirement is not only limited to Bayes but also applies to most traditional finance players in Kenya.

What’s an MPESA Statement?

An MPESA statement is typically a ledger document indicating the MPESA transaction history of users. It contains all the MPESA information depending on the period you choose. When sent, you have to type your password or ID number to open the document.

How to access your M-Pesa statement

You can access your MPESA statement in the following ways.

Through SMS

To retrieve an MPESA statement, you must first ensure you are using a Safaricom line. To access via SMS, simply follow the following steps.

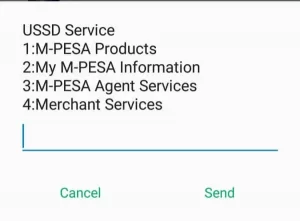

- Step 1; Dial the Safaricom’s USSD service short code *234#

- Step2; Respond by pressing 1 (MPESA statement)

- Step3; You can choose whether you need a full or mini statement on the next prompt

- Step4; You will receive a service reply message confirming that you will receive the statement in a while.

MPESA statement unlocks your loan potential

While mainstream finance institutions focus on CRB listing, most digital loan platforms focus on the financial health of individuals. This helps them ascertain the borrower’s financial ability.

Since most digital borrowers do not have traceable financial records, digital loan platforms use MPESA statements to guide them in disbursing loans. The higher the number of MPESA transactions the higher the chances of securing a higher loan limit. It is against this backdrop that loan applicants on most digital loan platforms are required to submit MPESA statements to ascertain their financial health.

What are the common loan evaluation criteria on digital lending platforms?

Every digital loan platform in Kenya has varied criteria used to evaluate loan applications. The following are common loan evaluation criteria on most online lending platforms.

- At least a six months MPESA statement

- CRB listing

- Loan repayment History i.e. Delays in loan repayment affects your loan limit

- Bank statement

However, loan evaluation criteria varies from one digital lending platform to another.

Final thought

Though digital lending is popular among Kenyans, the high number of defaulters calls for tighter measures to screen borrowers. This is why requirements such as MPESA statement, CRB, and many other stringent loan application requirements are gradually creeping into the digital lending market. Remember a healthy credit history is important to unlock higher loan limits across various digital lending platforms.

Do you have a clean credit record and need a loan? Simply download and install the Bayes app here to unlock your digital loan.